In this article, we will explore the tax obligations imposed on foreign individuals in Indonesia.

Whether you're involved in entrepreneurial activities or contemplating starting a private business, having a basic understanding of this subject can be quite beneficial.

Personal Income Tax Explained

Foreign individuals in Indonesia are subject to the personal income tax (PPH OP - Pajak Penghasilan Orang Pribadi).

This tax applies to anyone earning income in the country, whether they own a business or work for an Indonesian company.

Individuals must pay personal income tax, including taxes on dividends and other earnings, on all income earned within Indonesia. This tax obligation persists for the entire duration of the foreigner's stay in the country.

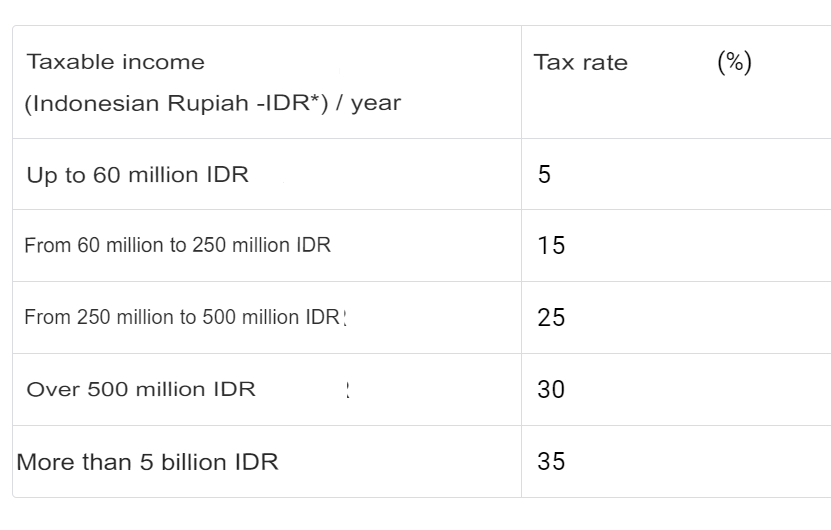

According to Indonesia's tax legislation, foreign citizens become residents and are considered tax subjects if they stay in the country for more than 183 days within a 12-month period or fiscal year. For residents, income tax rates range from 5% to 35% depending on the income amount.

The income of non-resident foreign individuals is subject to a flat rate income tax of 20% on the gross income (the revenue amount minus the cost of goods or services) derived from conducting commercial activities in the country. This is stipulated in Article 111 No. 2 of Perppu 2/2022, paragraph (1) of Article 26 of UU PPh.2.

The income tax (PPH) rates are progressive, which means that the tax rate increases as your income grows.

Taxable Income Rates (%)

Working KITAS Visa

Obtaining a Working KITAS Visa is essential for those seeking to work or

conduct commercial activities in Indonesia. This visa, typically issued for a

duration of one year, serves as a temporary residence permit and needs to be accompanied

by an IMTA work permit.

It's crucial to note that other categories of KITAS visas, such as those for

family reunions, retirement, or sponsorship purposes, do not authorize employment.

Indonesian authorities rigorously enforce these regulations, and individuals

found violating them risk deportation and potential blacklisting, which can

restrict future visits to the country.

If you're an employee, it's essential to discuss working KITAS visa with

your employer before commencing any work arrangements. Some employers may

decline to cover the costs associated with obtaining a KITAS, and in such

instances, it's vital to carefully consider the implications of working without

the proper visa. Working illegally can lead to dire consequences, as

immigration authorities are vigilant and unauthorized work is likely to be

reported.

Regarding income tax obligations, employers typically deduct taxes from

employees' salaries and remit them to the tax office, managing all tax and

accounting reporting. However, if you're self-employed, you'll be responsible

for filing your own tax reports or hiring an accountant to assist with this

process.

For any questions related to document submission and personal income tax, we recommend contacting Legal Indonesia. They offer comprehensive assistance in resolving all necessary inquiries. In addition to handling visa matters, Legal Indonesia provides full-service accounting and tax services for businesses, including:

- Filing tax and accounting reports;

- Investment reports;

- Tax advisory services;

- Obtaining tax identification numbers (NPWP).

Telegram - @legalindonesia / @LegalIndonesiaBot

WhatsApp – https://wa.me/628179677771

Taxpayer Identification Number (NPWP)

The NPWP (Taxpayer Identification Number) is a

crucial document required for all individuals working in Indonesia. This unique number is assigned to facilitate tax administration and

helps identify taxpayers in meeting their tax obligations.

To register for tax purposes, you'll need the

following documents:

- A copy of your passport;

- A copy of your work permit (IMTA);

- A copy of your limited stay permit (ITAS);

- A completed registration form;

- A power of attorney authorizing a tax specialist or representative to handle the registration process;

- A copy of the NPWP from the sponsoring company.

Filing a Tax Return (SPT)

To file a tax return in

Indonesia, you must have a registered NPWP number.

Many tax authorities accept

tax returns electronically, but you'll need to register and obtain an

electronic identification number (eFIN).

Under the Investor KITAS program,

foreigners are not required to register for NPWP. However, they may be subject

to a higher tax rate when calculating income tax.

Even if a foreigner stays in

Indonesia for a short period and earns income only once, they are still liable

to pay income tax. This includes foreign musicians or artists performing in

Indonesia.

There are exemptions from income

tax for certain foreign workers, such as foreign consular and diplomatic

personnel, military personnel, foreign civil servants, and international

representatives specified by the Minister of Finance.

Filing income tax returns (SPT) should be completed no later than three months after the end of the tax year, that is by March 31 of the following year for the reporting period. Timely payment and submission of the reports are crucial to avoid administrative penalties, which include fines of 100,000 IDR for each declaration that is not filed on time.

Deregistration from Taxation in Indonesia

To gain approval for deregistration from the tax office, an audit of tax returns and related documents is conducted.

For the audit, you need to provide all documents

related to your work activity. These may include bank statements, payslips,

employment contracts, and tax payment documents.

To be deregistered for taxation, the following

documents are required:

- A letter from the individual requesting the deregistration of their taxpayer identification number due to departure from Indonesia and cessation of work with the company;

- A statement from the company indicating that the individual no longer works for the company;

- The original tax identification card (NPWP);

- A power of attorney allowing a tax specialist/representative to proceed with the deregistration.

Exit Permit (EPO)

When foreigners leave Indonesia

without plans to return for work, they must obtain a special document known as

an "Exit Permit" (EPO) from the local immigration office. Along with

the EPO, they must also present a tax compliance certificate (Surat Keterangan

Pemenuhan Kewajiban Perpajakan or SKPKP) issued by the tax authority where they

are registered. This certificate proves that they have fulfilled their tax

obligations while residing in the country.

Failure to submit an EPO may result in the government considering the individual as a taxpayer, even after their departure from the country.