Open an account for a foreigner

Opening an account for a foreigner without a KITAS (KITAP) is currently impossible.

A trusted agency, @legalindonesia, can provide you with the service of opening a card.

They also open accounts in banks such as BNI and OSVS. Generally, in Indonesia, a foreigner cannot open a bank account without a KITAS (long-term visa).

We do not recommend turning to random guarantors, whom you might not be able to locate if you need to perform any actions with your account.

Cards at Permata

🟢 "Green" Card:

- Local (IDR only) - minimum deposit 100K,

- Multicurrency (IDR + three currencies) - minimum deposit 100K.

Daily limit 10 million IDR

Service fee - 7,500 IDR per month.

Information on daily transfer limits for the green multicurrency Permata card to other banks in Indonesia (IDR):

1. Quick Transfer (Online) 50M from the Permata X app + 50M from permatanet.com + 50M from an ATM. If the recipient's bank is registered in the BI-FAST system (e.g., Mandiri, BCA), the limit for instant transfers to them is 250M.

2. LLG limit 500M per day (processed on weekdays within 2 hours, cut-off time 1 PM).

3. RTGS transfer (from a bank branch) limit 500M per day.

🔴 "Red" Card - balance from 100 million IDR, daily limit 20 million IDR.

Service is free with a balance over 100 million IDR, 150K if the balance is less than 100 million IDR.

⚫️ "Black" Card - balance from 500 million IDR, daily limit 50 million IDR.

Service is free with a balance of 500 million IDR, 250K if the balance is less than 500 million IDR.

Limits as of 27.11.2023:

More about transfer limits on the bank's page.

SWIFT

Bank Name: PermataBank

Holder (full name): xxxx xxxx = NAME SURNAME (exactly in this order and without patronymic!!!)

SWIFT code / BIC: BBBAIDJA (or BBBAIDJAXXX)

Bank Account #: xxxxxxxxxx = your account: 10 digits without leading zeros

Important Note:

If you incorrectly enter the password/user ID more than 3 times, the app will be blocked and you will need to contact the bank.

Subscriber's tip: Go to the website, click "forgot password", follow the steps, and change the password.

Information on Outgoing SWIFT Transfers from Permata to an Individual's Account Abroad

Transfers can only be sent from a Permata Bank branch (at the cashier). Before sending, you will be given a form to fill out with the information from which account to debit, the amount, and where to send it. The operator will use this form to process the transfer.

Required Information for the Payment Recipient:

1. Full Name

2. Bank Name

3. Bank Address

4. Bank SWIFT code/BIC

- *For transfers to the USA, additionally the Routing Number*

- *For transfers to Australia, additionally the BSB Number*

Fees:

- Transfer fee:** 50,000 Rp (fixed amount)

-Commission:

- 0.125% of the transfer amount (all except Priority)

- 0.0625% of the transfer amount (for Priority)

- Minimum commission - 150,000 Rp

- Maximum commission - 2,000,000 Rp

There is a hypothesis that with the Priority tariff, both commissions are initially deducted and then refunded to the account. This was our experience.

Additional Service: Full Amount Guarantee (optional):

- Transfer in USD: 350,000 Rp regardless of the amount

- Transfer in EUR: 550,000 Rp regardless of the amount

This service guarantees that the amount sent is the amount received, i.e., correspondent banks do not deduct fees along the way.

Transfer Timing:

- Processing time: 3-5 business days. Our transfer was completed in 16 hours.

Transfer Amounts:

- No specific restrictions were communicated to me. Transfers over 10,000 USD are subject to additional scrutiny, as I understand it.

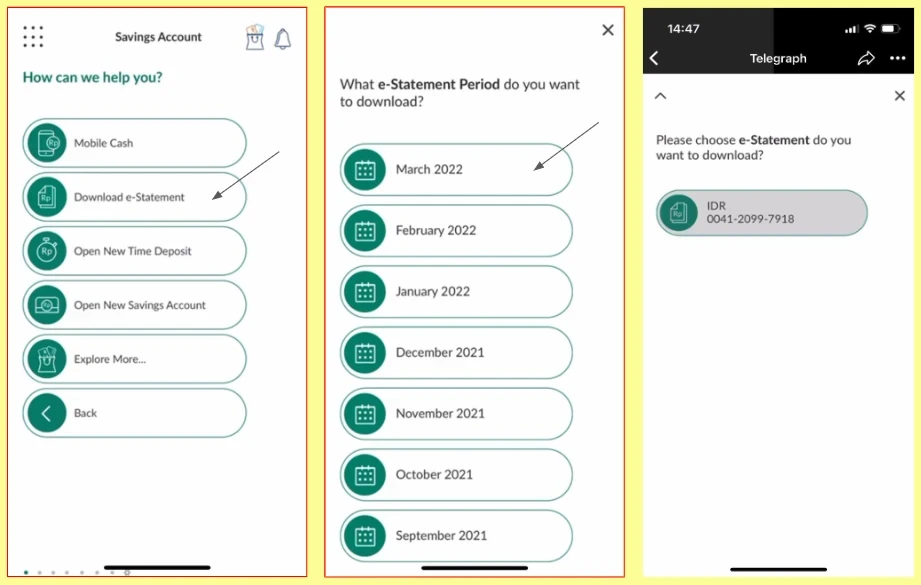

How to Request a Statement from Permata to Obtain an Address

How to Withdraw Money from an ATM Without a Card (MOBILE CASH)

Using Permata as an example (works similarly with BCA and MANDIRI). You can also withdraw at Indomaret cash registers.

This feature allows you to withdraw cash from a Permata ATM using your phone, without a plastic card.

1. From the main menu, select Mobile Cash > PermataBank ATM.

2. Enter your phone number in the format 08XX-XXXX-XXXX.

3. Select the amount you want to withdraw from the ATM.

4. Review all the entered information and confirm.

Next, go to a Permata ATM:

1. Press the Mobile Cash button.

2. Enter your phone number in the format 08XX-XXXX-XXXX.

3. Enter the code from the SMS that you receive on your phone.

4. Collect your money.

Daily Withdrawal Limits:

- BCA: max 10 million IDR (one transaction max 1,200,000 IDR).

- Mandiri: max 5 million IDR (one transaction max 1,000,000 IDR).

- Permata: max 1.5 million IDR.

Material by journalist and chat participant @PancaSyurkani.

Bank Account Number

You can see your account number (Account Number) directly in the app under the Valas Dinamis line. To do this, tap the Show Account line at the bottom of the app.

Card (Account) Operations

In the app, tap the Show Account line at the bottom > select the desired account > click on the Select Period button and choose the month for which you want to see transactions (transaction history).

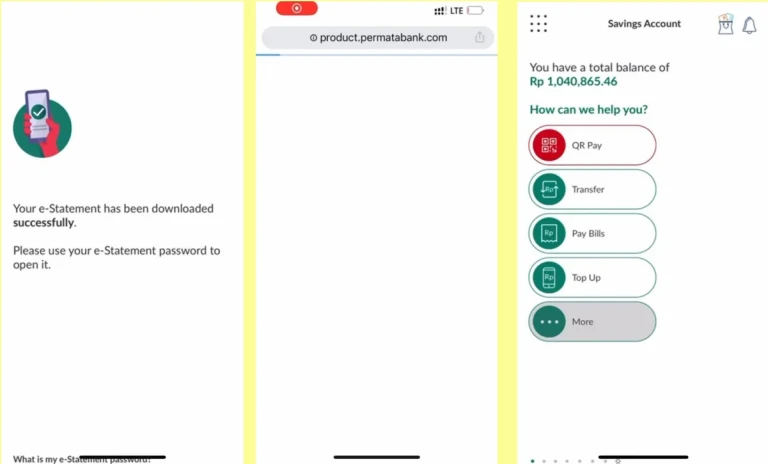

E-Statement

In Permata's mobile app, e-statements can only be downloaded/received for the past 12 months (relative to the current month), but the transaction history is available in the mobile app (not in the web version). To request statements for months that are not available in the mobile app but are needed for the past year's report, you can only do so at the branch with a passport, 100K/month/account, and wait for a week (request to the Jakarta office).

Conclusions:

1. Save all e-statements now (even if you don't need them) from the mobile app.

2. Transaction History (just a history, not e-Statement) can be downloaded: in the web version of Permata - by month, only for a year, in the mobile app - all by month (for some reason, from 2021, even though I've been with Permata since 2022).

The information is provided by the bank's client.

Phone Top-Up

In the app, select Top Up > Phone Top Up > enter the phone number in the format 08XX-XXXX-XXXX > choose the desired amount (Pulsa Rp), which will be credited to the phone account.

Currency Transfer Between Your Accounts

Currency exchange (transfer) between your accounts is only possible using Indonesian Rupiah (IDR). For example, you cannot directly transfer from USD to EUR. You will need to perform a double conversion in the app: USD > IDR > EUR.

Before exchanging currency, you need to go to the app settings (Services) and select Register Forex Transactions and press Next. By doing this, we confirm that we will be conducting currency operations without any documents for amounts up to $100,000 USD per month. This confirmation needs to be done every month before exchanging currency.

To exchange currency, select Transfer > My Permata Account in the app:

- You are transferring from — select the account you're transferring from.

- You are transferring to — select the destination account.

- Amount — enter the transfer amount in the currency of the destination account.

If My Permata Account is not working (the program crashes), you can select Transfer > Account

Number and enter your account number. You can see your account number (Account Number) directly in the app under the Valas Dinamis line (you can input the account number without leading zeros).

You can view Permata Bank's exchange rate in the app: go to settings (Services) and select Exchange Rate.

For more accurate Permata Bank currency exchange rates, check the website, specifically the Demand Draft section: Currency Exchange Rates.

Transfer scheme and rates:

- IDR > USD

- Demand Draft / USD / Sell

- USD > IDR

- Demand Draft / USD / Buy

- IDR > EUR

- Demand Draft / EUR / Sell

- EUR > IDR

- Demand Draft / EUR / Buy

Limits on Transfers

You can check here: Fee and Limit.

Transaction Limit — limits on transfers.

Transaction Fee — fee amounts.

More about limits in section 2 of the contents.

Browser Application

You can access your account not only through the mobile app on your phone but also in the browser on the internet. The browser application is called PermataNet.

Website: https://www.permatanet.com/

Customer Support

Email: care@permatabank.co.id

You can write in English - they respond normally (within a day or the next day).

More Useful Information

- If you plan to leave Indonesia, inform the bank in writing / by phone / at the office / via email at care@permatabank.co.id. Otherwise, your card may be blocked.

- If you encounter problems abroad, contact international support via email or phone at +622129850611.

- By calling the bank, you can remotely change your phone number.

You can add one right now!