Starting February 14, 2024, tourists arriving in Bali must complete an additional procedure: paying a tax of 150,000 rupiah (about $10).

The island authorities promise to use this money to combat the waste issue on the island.

Since the launch of the new tax, the authorities have reported collecting $100,000 from visitors to Bali.

At the moment, the payment is voluntary as the authorities do not yet have a system in place to ensure all foreign tourists pay the tax.

Once the necessary system is established, all foreign visitors will be required to pay the tax before leaving Indonesia.

You will be able to make the payment before your arrival, during your stay, or upon leaving Bali.

Those who have not paid the tax prior to their arrival or upon entry at the airport can do so at accredited travel agencies or hotels in Bali, although the number of these locations is currently limited.

The authorities also promise a straightforward procedure for departing passengers at the airport, claiming it will take only 23 seconds.

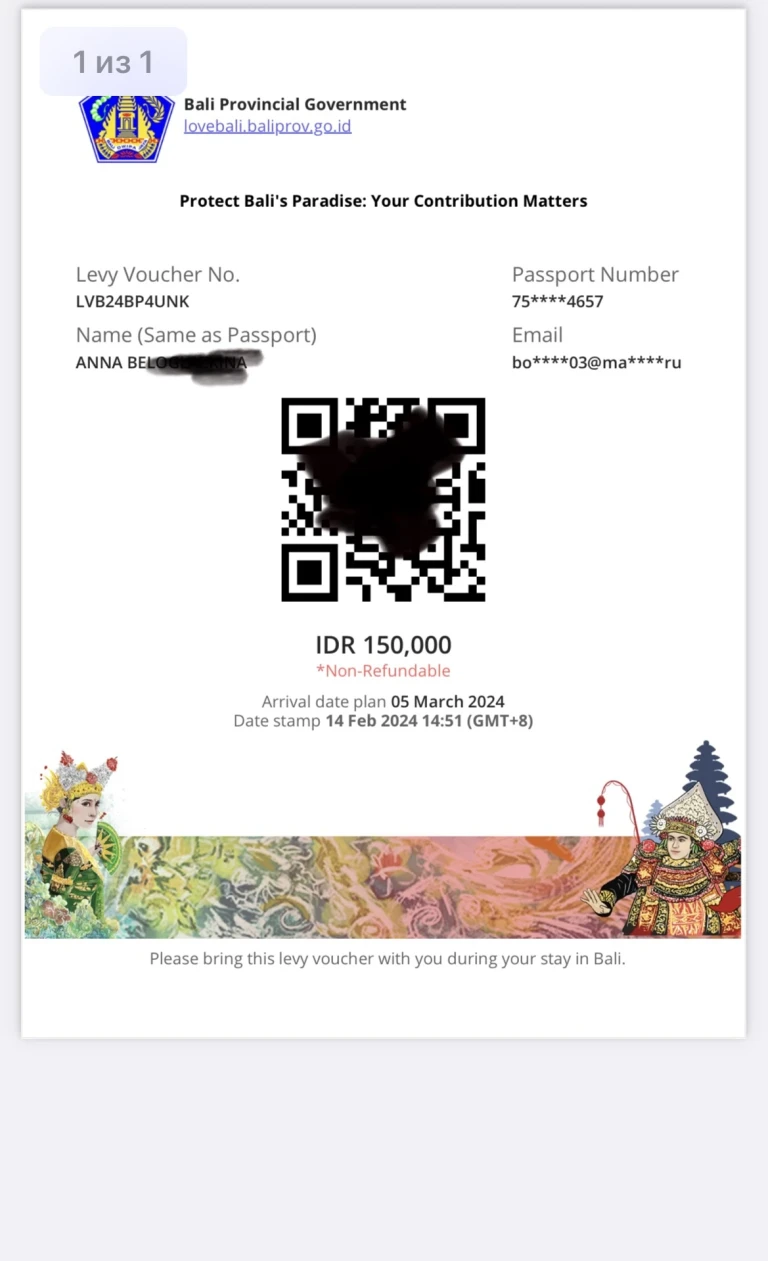

The payment will be checked at departure. Proof of tax payment will be in the form of a QR code that you can either print out or present on your device.

To make the process easier, a dedicated website has also been created.

Let's test it out.

Online Tax Payment

At first glance, the website appears intuitively clear. On the main page, there are just two buttons:

- Pay Tourist Levy – for tax payment.

- Apply Exemption – for those exempt from tax payment. This category includes KITAS holders.

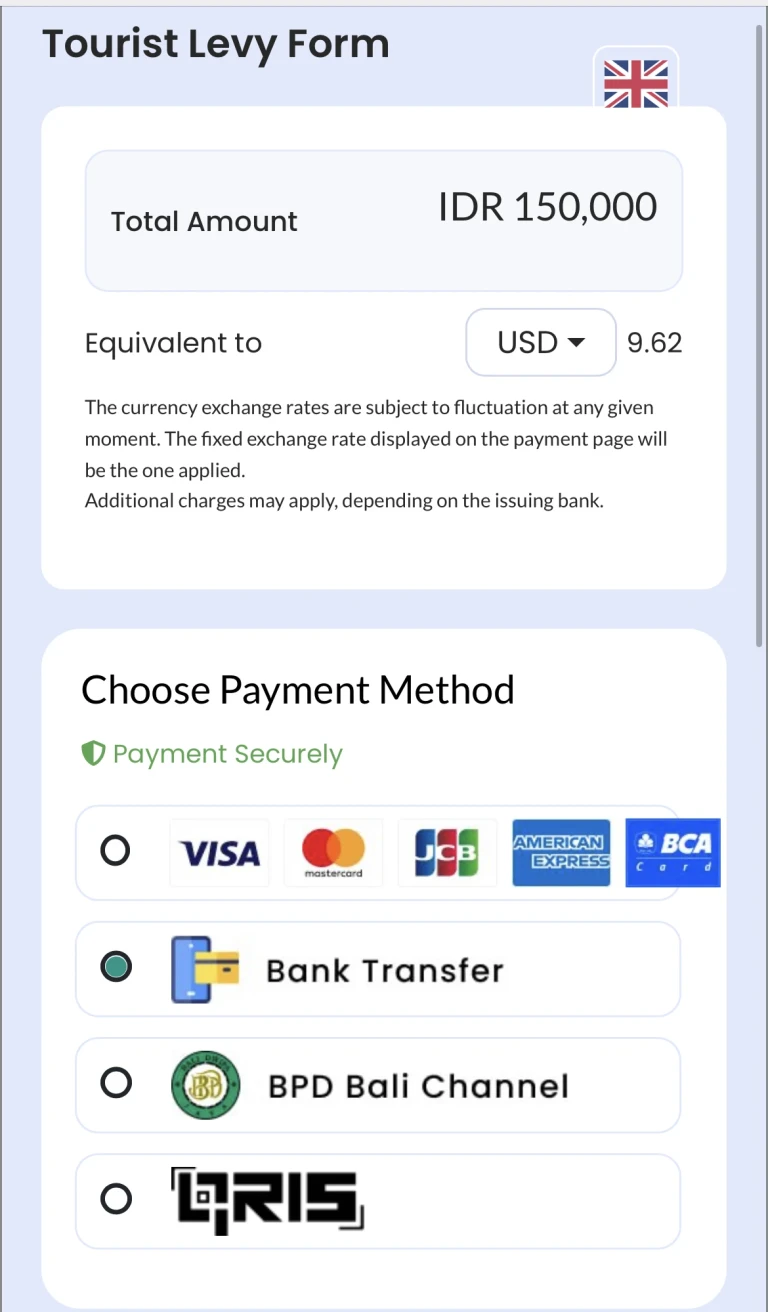

When we click on Pay Tourist Levy, we are prompted to choose a payment method. Options include card, bank transfer, or QIRIS.

Choose any method that suits you.

We opted for bank transfer.

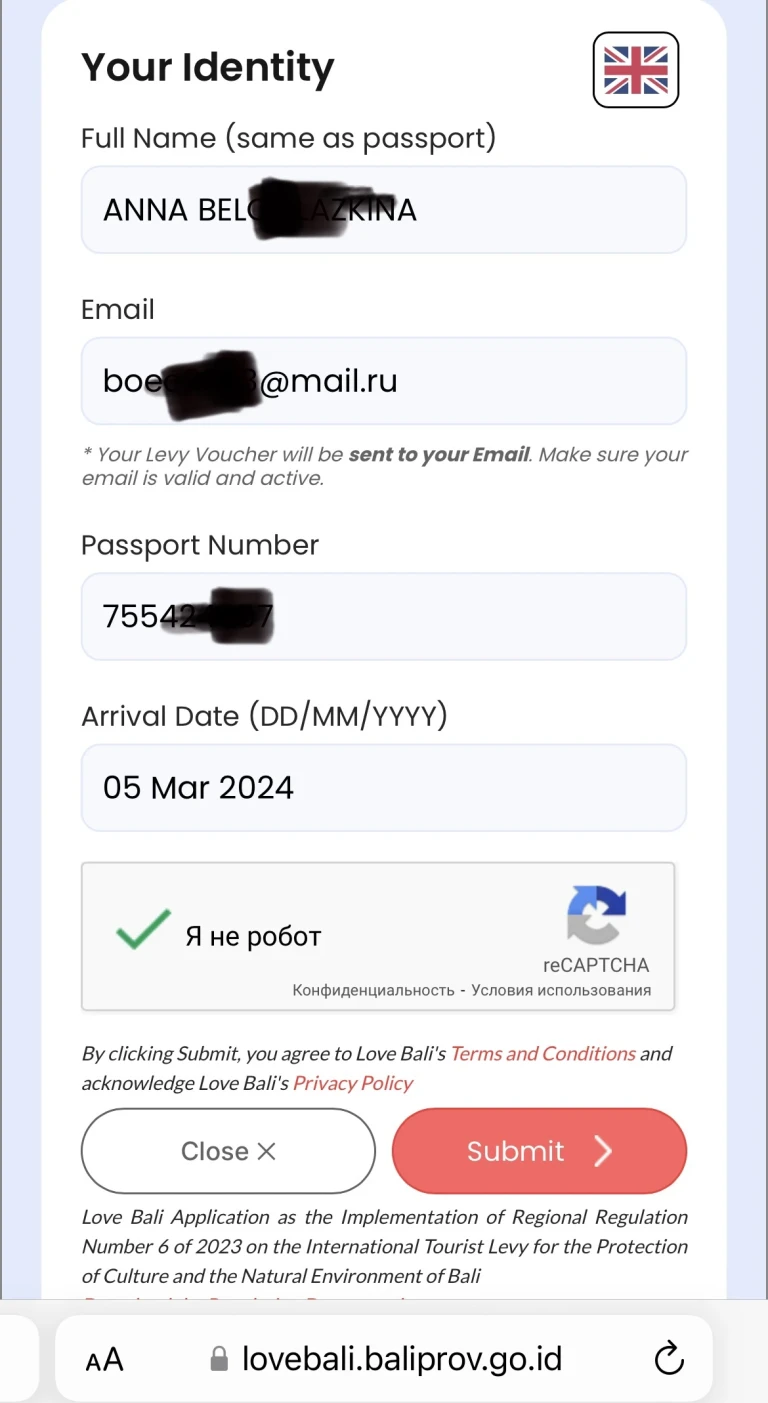

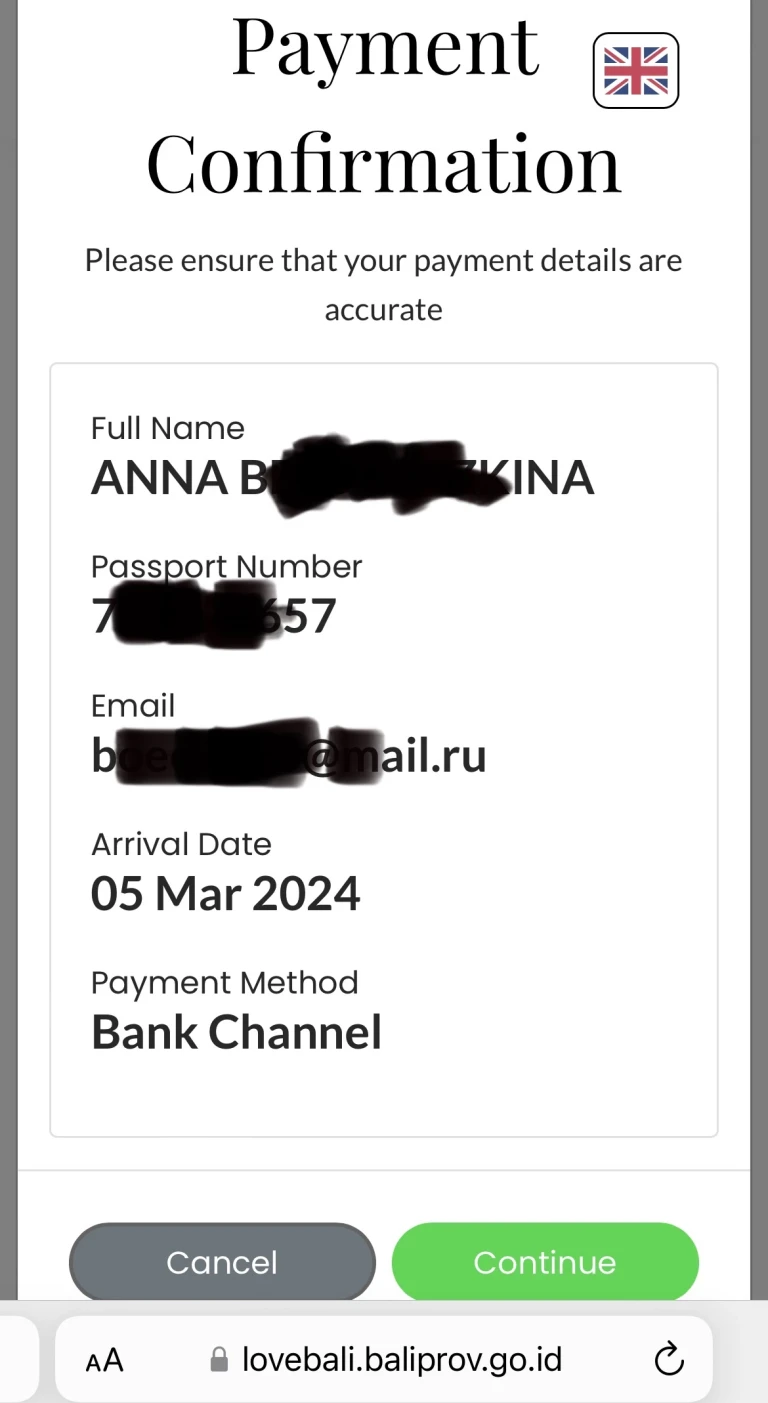

Fill out the form with your full name, passport details, arrival date, and email address where the payment confirmation will be sent.

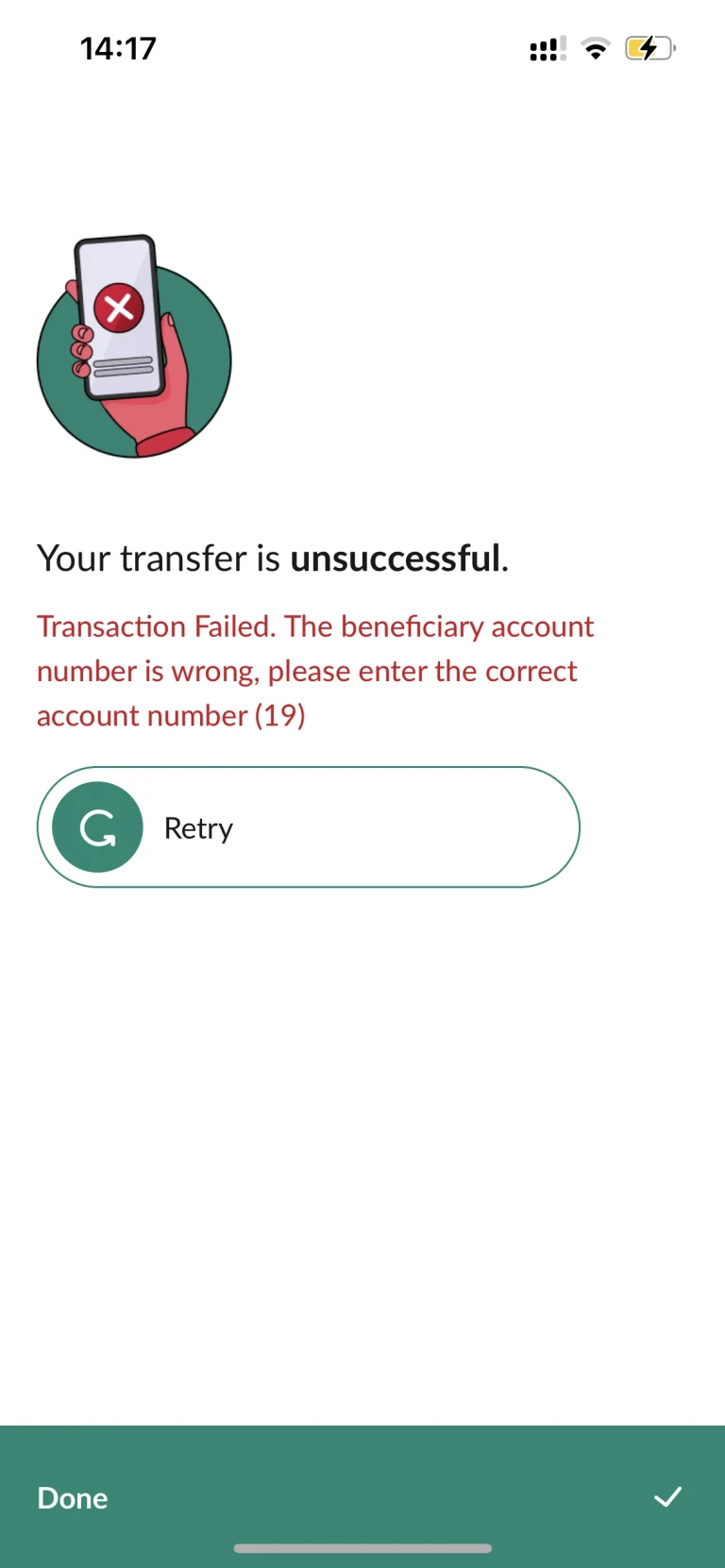

However, it turned out that the bank transfer option was not functioning when we attempted to make the payment on February 14, 2024.

Attempts to make payments from three separate Indonesian bank accounts—Permata, BRI, and BCA—failed when transferring to the account specified on the website.

We then opted for card payment, but encountered the same issue: the payment did not go through.

We tried QIRIS.

The site issues a QR code, which we paid with BCA bank (it was also possible to pay with Permata).

After the money successfully left our account, we discovered that the button needed to obtain our receipt was inactive.

After a rather stressful half-hour, a confirmation email arrived at the address we provided in the form. The message confirmed that the payment had gone through and included a QR code that serves as proof of tax payment.

It's important to note that Bali authorities advise visitors to keep their QR code accessible until the end of their trip, as the tax payment is checked upon departure from the island.

For those who do frequent visa runs: note that you will have to pay 150,000 rupiah each time you cross the border.

If you have a residence permit (e.g. KITAS), you need to fill out the exemption form on the website 30 days before your planned arrival date on the island.

You can add one right now!