Indonesia is widely recognized as a rapidly growing economy with significant

potential for investment and business expansion. The country offers abundant

opportunities for investors and entrepreneurs, thanks to its wealth of natural

resources, including high-quality oil, tin, bauxite, nickel, manganese, lead,

copper, zinc, chromium, gas reserves, and precious stones.

Indonesia is a leading global exporter, holding the top position in palm

oil, the fifth in liquefied gas, and exporting large quantities of coal, tin,

agricultural products (such as natural rubber, copra, coffee, tea, and spices),

along with tropical timber and wood products.

The Indonesian government actively supports the country's economic

development by creating favourable conditions and closely monitoring the

economy and geopolitical landscape. Despite global challenges, Indonesia

continues to take steps to harness its natural resources, boost the

competitiveness of its exports, minimize the risk of financial instability, and

enhance the profitability of production in collaboration with its key trading

partners.

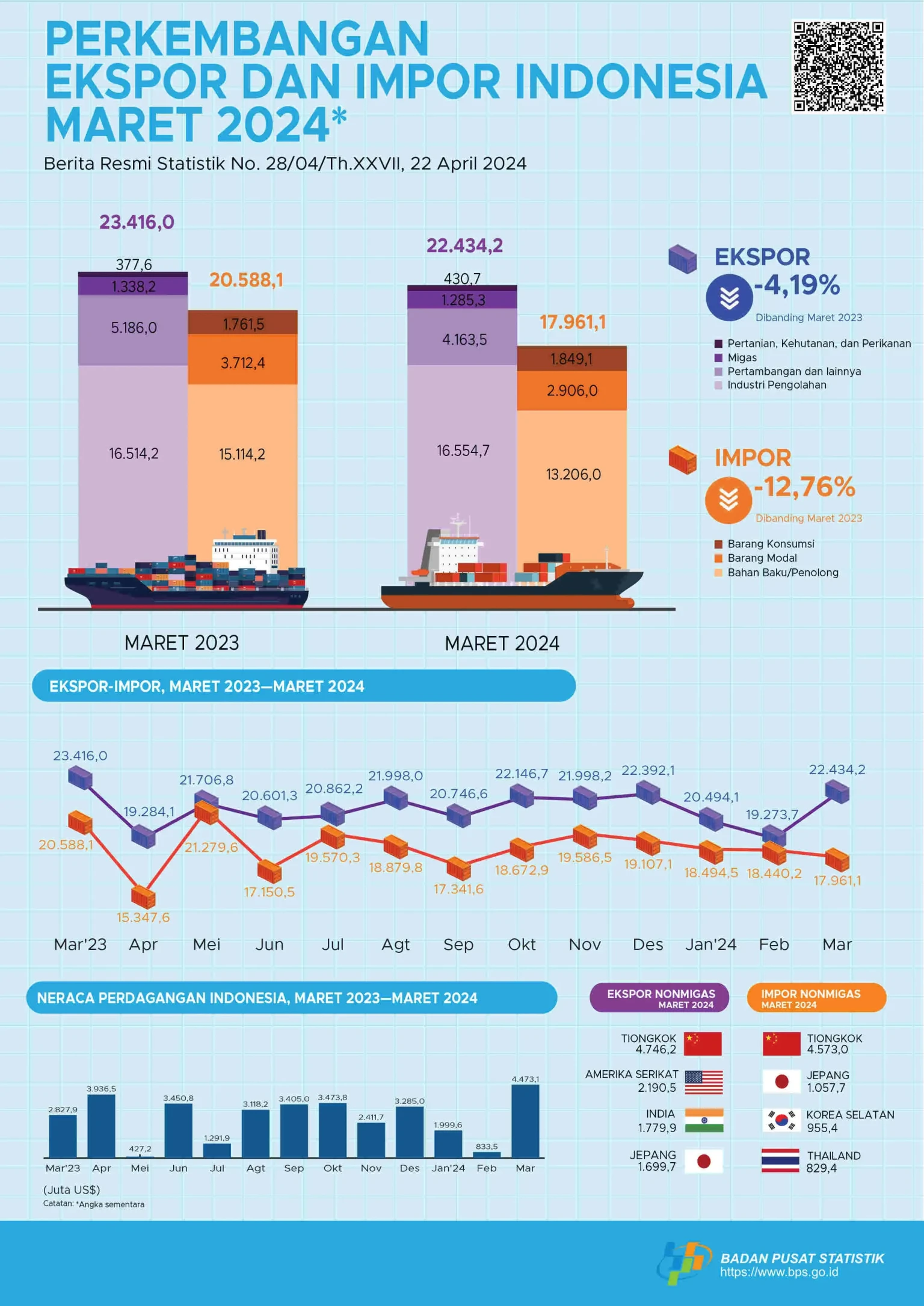

Export Performance and Trade Balance

Trade Surplus and Key Markets

In March 2024, Indonesia posted a trade surplus of USD 4.47 billion,

continuing the positive trend of exports exceeding imports that began in May

2020. This figure is USD 1.64 billion higher than the surplus recorded in

February 2024 and significantly above the USD 2.83 billion surplus from March

2023. From January to March 2024, Indonesia’s export surplus reached USD 7.31

billion.

Indonesia’s neutral political stance and strategic location make it an

attractive hub for global investors. With a population of 280 million, Indonesia’s

online services market is booming, valued at USD 77 billion in 2022 and

expected to reach USD 130 billion by 2025. Tech giants like Gojek and Tokopedia

have merged to launch an IPO in the U.S., while Apple, Microsoft, and Tesla are

expanding their presence in the country.

Febrio Kacaribu, Head of the Fiscal Policy Agency at the Ministry of

Finance, praised Indonesia’s economy, stating, “We must be grateful for our

success, especially in the face of global economic uncertainty. Indonesia’s

trade surplus reflects the country’s strong domestic economic resilience.”

Non-Energy Export Sectors

From January to June 2024, exports from Indonesia’s manufacturing sector

(excluding oil and gas) grew by 0.40% compared to the same period in 2023.

Similarly, exports from the agricultural, forestry, and fisheries sectors

increased by 6.73%, while exports from mining and other industries declined by

15.05%.

In June 2024, Indonesia's largest non-energy export market was China (USD

4.65 billion), followed by the U.S. (USD 1.97 billion) and India (USD 1.84

billion), with these three countries accounting for 43.13% of total exports.

Exports to ASEAN and the European Union (27 countries) totaled USD 3.62 billion

and USD 1.21 billion, respectively.

West Java was the top exporter from January to June 2024, contributing USD

17.99 billion (14.39% of the total), followed by East Kalimantan with USD 12.57

billion (10.04%), and East Java with USD 12.20 billion (9.76%).

Overall, Indonesia’s exports from January to June 2024 amounted to USD

125.09 billion, a 2.76% decrease from the same period in 2023. The value of

non-energy exports, totalling USD 117.19 billion, also dropped by 2.99%. Among

the highest-value exports, most raw materials showed growth, particularly

mechanical equipment, which saw a USD 263.6 million increase (26.66%). However,

animal and vegetable fats and oils declined by 14.32%.

Despite some declines, Indonesia’s GDP in purchasing power parity (PPP)

terms reached USD 4.73 trillion, making it the third largest economy in Asia

and the tenth largest globally.

Total Exports and Challenges

March 2024 Export Performance

In March 2024, Indonesia's total exports reached USD 22.43 billion, marking

a 4.19 percent decline compared to the same period last year. However, exports

showed a strong rebound from the previous month, increasing by an impressive

16.40%, driven largely by rising global commodity prices, particularly for coal

and precious metals.

By June 2024, most of the top ten non-energy export products saw price

declines. The steepest drop occurred in precious metals and jewellery/gems,

which fell by USD 440.5 million (45.76 percent). Animal and vegetable fats and

oils also experienced a significant decrease, dropping by USD 1,091.5 million

(68.06%).

Impact of China’s Economic Slowdown

China continues to be Indonesia's largest trading partner, representing

22.44% of Indonesia’s total exports. However, the recent slowdown in China’s

economy, driven by its real estate crisis, has had a negative impact on trade

between the two countries. In particular, mining exports have decreased.

On the positive side, Indonesia’s agricultural exports are growing steadily,

supported by increased demand from key partners like the U.S. and India.

Imports

Import Figures and Key Categories

In June 2024, Indonesia’s imports totalled USD 18.45 billion, down 12.76%

compared to the same period last year. This decline was driven by a 16.72% drop

in non-energy imports, despite a 10.34% rise in oil and gas imports. From

January to March 2024, Indonesia’s total import volume reached USD 54.90

billion.

In May 2024, the value of imports reached USD 19.40 billion, showing a

14.82% increase in the volume of goods imported, but an 8.83% decrease in total

value compared to the same period last year. Non-energy imports totalled USD

16.65 billion, with a 19.70% rise in tonnage, though still an 8.23% decline

compared to the previous year. Gas imports were valued at USD 2.75 billion,

reflecting a 7.91% decrease in the volume of imports and a 12.34% decline in

value compared to the same period last year.

Changes in Key Trade Partners

Imports were primarily categorized into raw materials and auxiliary

materials, followed by capital goods and consumer goods. The largest increases

in non-oil and gas imports came from China, the U.S., and Thailand, while the

Netherlands experienced the sharpest decline in non-oil and gas imports.

Example Success Stories: Wine and Nickel

Wine: Bali’s wine industry has seen remarkable sales

growth, particularly Hatten Wine. The company projects significant increases in

wine consumption and distribution across Jakarta and other regions in the

second half of 2024. According to Financial Director Ketut Sumarwan, operating

profit surged by 19.45%, rising from IDR 22.80 billion in 2023 to IDR 27.24

billion in 2024.

This growth was driven by a 24.85% increase in foreign tourists to Bali,

reaching 3.1 million by June 2024. The winery reported a profit of IDR 21.08

billion in the first half of 2024, a 17.08% rise compared to the previous year.

Total revenue grew by 12.07% to IDR 123.28 billion, while gross profit

increased by 12.5%, reaching IDR 56.51 billion.

Ida Bagus Rai Budyarsa, founder of PT Hatten Bali, credited this strong

revenue and profit growth to rising wine consumption both on and off the

island.

Nickel: Indonesia is the world’s largest nickel producer,

controlling more than half of global production. The country manages the entire

value chain—from raw materials to electric vehicles and batteries—which

significantly boosts its economic growth.

Economic Prospects for 2024

The World Economic Outlook (WEO) report, released in April 2024,

forecasts global growth at 3.2%, still falling short of historical averages.

In 2024, global trade faces several key challenges, including geopolitical

tensions, volatile exchange rates, and financial sector instability.

Additionally, the economic slowdown in China, Indonesia’s primary trading

partner, raises further concerns. However, despite these challenges,

Indonesia’s non-energy exports grew in May 2024 compared to April. Export

growth was recorded in major markets such as China, the U.S., and Japan, along

with increased exports to ASEAN countries and the European Union.

Indonesia's Economic Growth Exceeds Expectations

Despite global economic challenges, Indonesia’s export performance and trade

activities have surpassed analysts’ predictions. The country is becoming

increasingly appealing to international investors due to its fast-paced

economic growth, youthful and dynamic population, infrastructure development,

strategic location, and wealth of natural resources.

According to Indonesia’s statistical agency, the country’s GDP grew by 5.05%

in the second quarter of 2024. This represents a 15-fold increase, pushing GDP

to USD 1.5 trillion, making Indonesia the third-largest economy in Asia, behind

only China and India—an outcome that exceeded expectations.

The rapid growth has been driven primarily by the manufacturing,

construction, and trade sectors. With each milestone and strong export

performance, Indonesia’s economy continues to thrive and expand.

Translated from the original article by Mila Soloman

You can add one right now!