When embarking on a new business venture in Indonesia, it's vital to grasp

the different types of organizational structures accessible to entrepreneurs,

considering their attributes and prerequisites.

Here are the commercial entities that can be established in Indonesia:

- Limited Liability Company (PT)

- Private Enterprise (BUMS)

- Sole proprietorship (UD)

- Representative office (KPPA)

- Subsidiary company (typically a PT)

Limited Liability Company – Perseroan Terbatas (PT)

Perseroan Terbatas (PT) is a type of company referred to as a Limited Liability Company. It's a legal entity where ownership is divided into shares.

One significant advantage of PT is the limited liability protection it

offers to shareholders. This means that shareholders' personal assets are

protected if the company encounters financial difficulties, as their

liabilities are restricted to the value of their unpaid shares in the company's

capital. Moreover, shares can be easily traded, and ownership can be

transferred without the need to dissolve the company.

In Indonesia, there are two primary types of PT:

- Local PT companies

- Foreign PT PMA companies

Local PT Companies

Local PT companies in Indonesia can only be fully owned by

Indonesian citizens. However, if a foreigner wants to establish such an

enterprise, they'll need to involve local nominal shareholders.

These local nominal shareholders hold shares on behalf of

foreign investors. They're commonly utilized when foreign investors seek to

start a business in Indonesia, especially in sectors restricted or not fully

open to foreign ownership. Involving local nominal shareholders allows foreign

investors to navigate regulatory restrictions and launch ventures in various

industries, even those typically closed to foreigners. Essentially, these

shareholders act as proxies for foreign ownership in sectors where full foreign

ownership isn't allowed.

The primary requirements for establishing a local PT company

include:

- One local director

- Two local shareholders

- One local commissioner

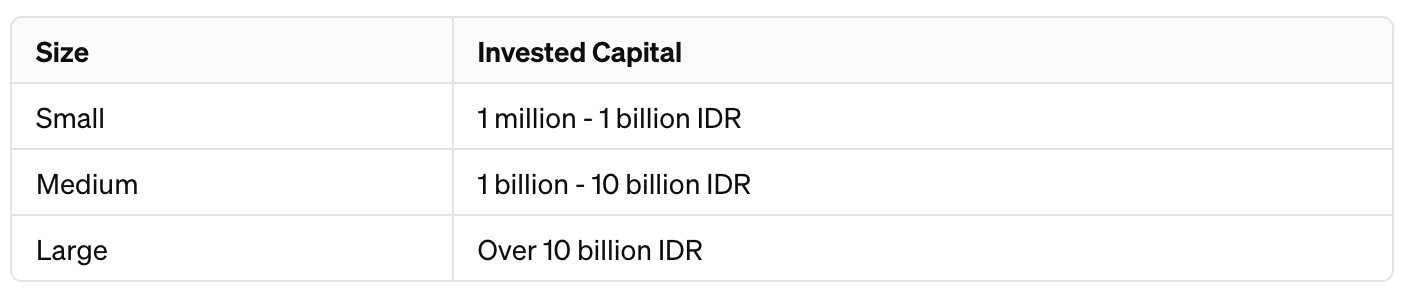

Local PT companies in Indonesia come in three different

sizes, categorized based on the amount of capital invested:

Foreign-owned PT PMA Companies

PT PMA companies in Indonesia are limited liability

companies with foreign ownership. They have the flexibility to be fully owned

by foreigners, eliminating the need for Indonesian shareholders, but this

applies only if the company operates in sectors allowing foreign investment.

Otherwise, forming a joint venture with Indonesian entities may be required.

The minimum requirements for a foreign-owned company

include:

- Having two foreign individuals or legal entities, or a combination with local shareholders.

- Employing at least one local director.

- Appointing one foreign or local commissioner.

The invested capital must be a minimum of 10 billion IDR.

To verify the payment of the company's capital, specific

documents are required:

- A copy of the deposit receipt or bank statement under the PT's name or a joint account in the founders' name. Alternatively, an original letter of statement on the paid-up capital, signed by all members of the Board of Directors, founders, and authorized PT members, if the capital is in cash.

- An original assessment report from an independent expert or evidence of goods purchase if the capital is pledged in a non-cash form. If collateral is in real estate, include evidence of advertisement in the newspaper.

- A copy of the government decree and/or finance minister's decree for a limited liability company. Alternatively, a regional decree if the founder is a regional company or the government of the province/regency/city.

- A copy of the consolidated PT balance sheet or the balance sheet of a non-legal entity included in the paid-up capital.

The original letter-report confirming the paid-up capital in

the PT must be notarized and signed by all members of the Board of Directors,

founders, and authorized PT members.

Legal agencies often assist in

facilitating the signing process, as clients may not be able to provide

evidence of the full 10 billion IDR at once.

Private Enterprises – Badan Usaha Milik Swasta (BUMS)

Private Enterprises can be divided into three types:

- Firm – Firma (FA)

- Limited Partnership, Limited Liability Partnership – Commanditaire Vennootschap (CV)

- Limited Liability Company – Perseroan Terbatas (PT)

Firma (FA) - Firm

Firma

(FA) is a type of private company that can be established by two or more

Indonesian individuals. In this structure, each partner possesses equal

authority to manage the company and make decisions, with no limitations on

their responsibilities based on their role as partners. Unlike some other

business structures, Firma is not a separate legal entity from its owners.

Consequently, there is no safeguard for personal or company assets. If the

company accumulates debts, the partners are personally liable to settle the

debt using their personal property.

Key

requirements for FA include:

- Must have a minimum of two company founders.

- Goals and objectives must align with Indonesian laws and regulations.

- Must have a trade name.

- Must have a designated place of business.

- Management is appointed by the founders.

Limited Partnership – Commanditaire Vennootschap (CV)

In a CV, there are two types of partners:

- Active partners: They contribute capital and manage the business.

- Passive partners: They solely provide capital.

Establishing a CV does not necessitate a minimum capital and is among the

simplest organizational structures. However, a CV does not constitute a

distinct legal entity and does not safeguard the personal assets of the

partners.

Requirements for setting up a CV:

- At least two individuals serving as founders of the company.

- The founders must be Indonesian citizens.

- A notarized deed in the Indonesian language.

- 100% local ownership.

Limited Liability Company – Perseroan Terbatas (PT)

See information on Limited Liability Company – Perseroan

Terbatas (PT) above.

Sole Proprietorship – Usaha Dagang (UD)

Sole Proprietorship, also known as Usaha Dagang (UD), is the

most straightforward business structure in Indonesia. It involves a single

individual operating the business without the need for partners or

shareholders. In UD, there is no legal distinction between the owner and the

individual entrepreneur.

To establish a Sole Proprietorship (UD), you need to fulfil

the following requirements:

- Choose a company name.

- Obtain an employee identification number.

- Provide a letter of permanent residency.

- Acquire a business license.

Representative Office – Kantor Perwakilan Perusahaan Asing (KPPA)

A Representative Office in Indonesia is a type of business

entity established by foreign companies to explore the Indonesian market,

conduct market research, and represent the interests of the parent company.

The primary purpose of a Representative Office is to serve

as a liaison between the foreign parent company and potential clients,

partners, or customers in Indonesia.

Representative Offices are restricted from engaging in

profit-generating activities or conducting direct commercial transactions in

Indonesia. They cannot enter into contracts that involve the sale of goods or

services, and all financial transactions must be managed by the foreign parent

company.

Unlike other foreign-owned companies in Indonesia,

representative offices do not require a minimum capital investment.

They are permitted to employ both local and foreign staff

members.

The license for this company type is valid for two years,

after which renewal is necessary to continue operations in Indonesia.

There are three types of Representative Offices in

Indonesia:

- Foreign Representative Office

- Foreign Construction Representative Office

- Foreign Trade Representative Office

Foreign Representative Office

- The representative office functions as a manager, coordinator, and representative of the company's interests in Indonesia.

- It refrains from conducting profit-generating activities, entering into contracts, or purchasing goods or services from local companies.

- The office is not permitted to engage in activities or have involvement with other types of companies operating in Indonesia.

- It maintains its role solely as a representative of its foreign parent company and refrains from involvement in any other business ventures within Indonesia.

Foreign Construction Representative Office

- Engages in various activities within the construction sector.

- Provides construction-related services and undertakes projects involving high risk, advanced technology, or significant expenses through collaborative efforts.

- Conducts construction work under the authorization of the Foreign Construction Representative Office Department.

Foreign Trade Representative Office

Activities include:

- Authorized to engage in various activities related to trade and marketing.

- Represents, promotes, and enhances the marketing of products manufactured by foreign companies.

- Provides information or instructions regarding the use and importation of the company's products to customers or users.

- Conducts market research and supervises product sales to promote products in Indonesia.

- Conducts market research for sourcing products from Indonesia.

- Negotiates and enters into contracts with Indonesian companies on behalf of the parent company.

Subsidiary Company

A subsidiary company in Indonesia is a distinct legal entity

from its parent company, operating independently despite the parent's

ownership. For instance, if a foreign company expands into Indonesia, it might

establish a subsidiary, typically registered as a limited liability company or

foreign investment company (PT PMA).

The main aim is market access and conducting business within

Indonesian legal parameters. Subsidiaries abide by Indonesian laws, which can

differ from their parent company's jurisdiction. Tax-wise, they are Indonesian

tax residents, meeting obligations to the local government.

In summary, subsidiaries offer a framework for parent

companies to operate in Indonesia while maintaining legal separation and

autonomy.